Dividends and shareholder benefits

1. Dividend policy

Our basic policy concerning dividends is to set the guideline of our dividend payout ratio at 35% on a consolidated basis and pay dividends flexibly based on performance.

We use retained earnings for new technology/product R&D and for infrastructure and working capital necessary for business growth in order to strengthen business foundation and increase shareholder value.

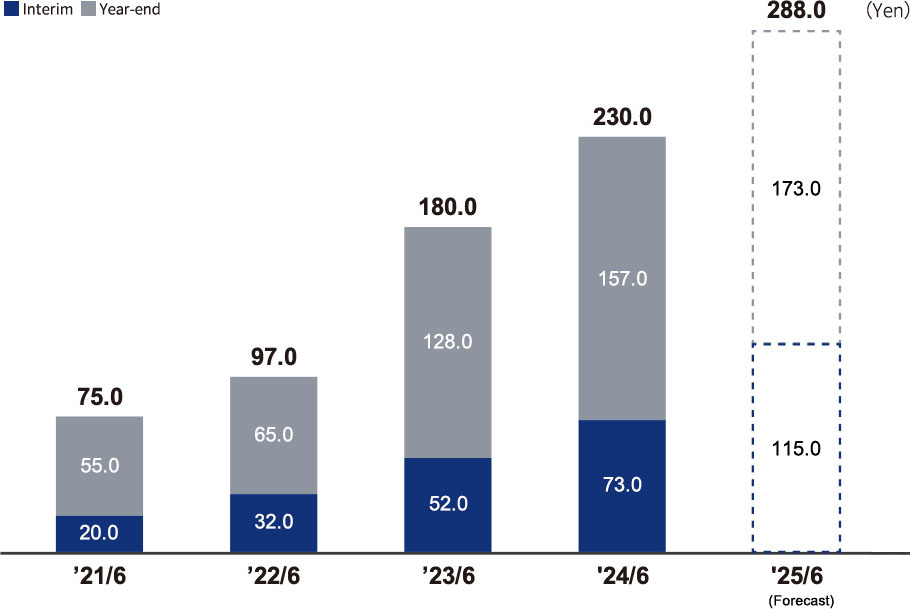

2. History of dividend payouts

| Fiscal year | Effective date | Dividends per share | Payout date |

|---|---|---|---|

| Interim dividend for FY ended June 30, 2025 | December 31, 2024 | 115.0yen | March 07, 2025 |

| Year-end dividend for FY ended June 30, 2024 | June 30, 2024 | 157.0yen | September 27, 2024 |

| Interim dividend for FY ended June 30, 2024 | December 31, 2023 | 73.0yen | March 06, 2024 |

| Year-end dividend for FY ended June 30, 2023 | June 30, 2023 | 128.0 yen | September 29, 2023 |

| Interim dividend for FY ended June 30, 2023 | December 31, 2022 | 52.0 yen | March 08, 2023 |

| Year-end dividend for FY ended June 30, 2022 | June 30, 2022 | 65.0 yen | September 29, 2022 |

| Interim dividend for FY ended June 30, 2022 | December 31, 2021 | 32.0 yen | March 04, 2022 |

| Year-end dividend for FY ended June 30, 2021 | June 30, 2021 | 55.0 yen | September 29, 2021 |

| Interim dividend for FY ended June 30, 2021 | December 31, 2020 | 20.0 yen | March 05, 2021 |

Dividends per share (Yen)

3. Plan to purchase own shares

None currently.

4. Special benefits for shareholders

None currently.